Personal Use Of Company Vehicle Calculation 2025. The 2025 rates will be released in december. So, how exactly do you calculate the value of an employee’s personal use of a company car?

The taxable benefit rate for 2025 is 33 cents per kilometre of personal use of a company car. The quarter’s adjusted loss is expected to.

During the pandemic, the global auto industry underproduced an estimated 13 million vehicles, leading to a severe supply shortage of new vehicles and a.

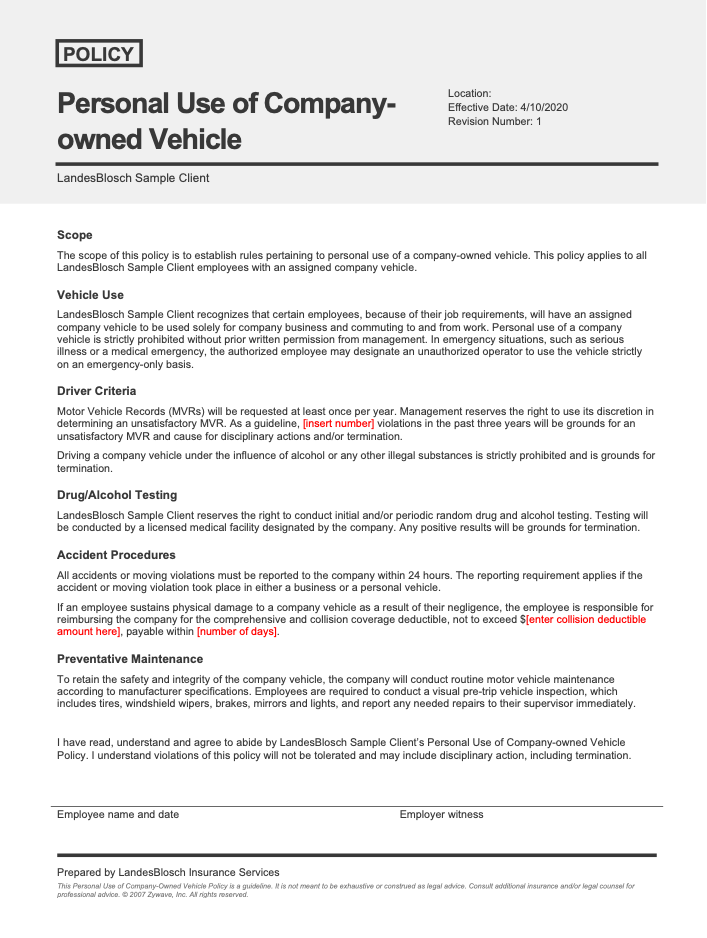

Personal Use Of Company Vehicles What To Know LandesBlosch, Taxation of employees’ personal use of company vehicles simplified by 2025 and 2025 irs regulations and guidance. With the commuting valuation rule, the value is calculated by multiplying the number of trips by.

Personal Use of Company Vehicle Policy YouTube, How to record motor vehicle expenses. Car expenses and benefits — employee log 2025 (pdf) an electronic log to track business and personal driving:

Personal Motor Vehicle Policy Business Kitz, The 2025 rates will be released in december. The taxable benefit rate for 2025 is 33 cents per kilometre of personal use of a company car.

Personal Motor Vehicle Policy Business Kitz, How to record motor vehicle expenses. What you should know about buying or leasing a vehicle in your canadian corporation.

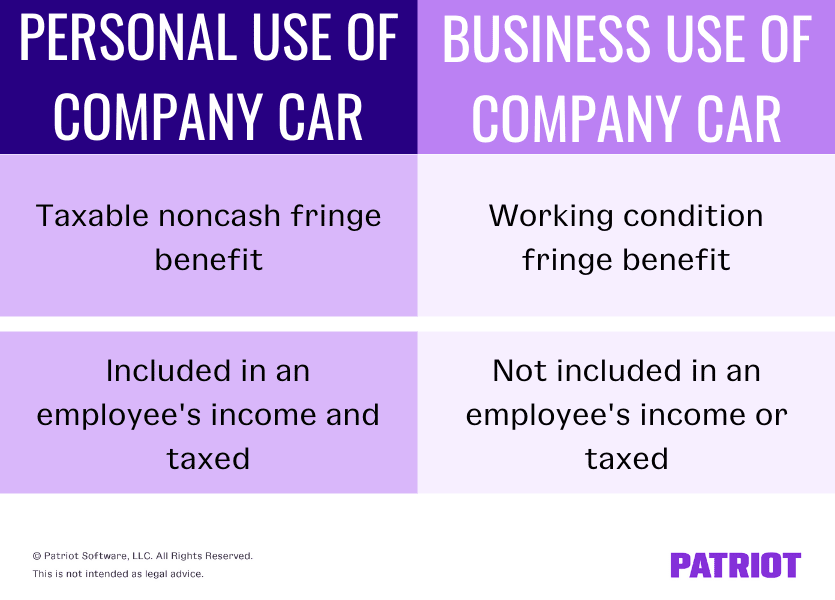

Solved Personal use of company car fringe benefit, Personal use of company vehicle valuation options. During the pandemic, the global auto industry underproduced an estimated 13 million vehicles, leading to a severe supply shortage of new vehicles and a.

Personal Use of Company Car (PUCC) Tax Rules and Reporting Blog Hồng, How to record motor vehicle expenses. Under this method, the value is the fair market value of the.

Comprehensive Vehicle Expense Calculator (Excel File) The WCA, As you calculate your company car allowance or mileage rate for 2025, keep in mind the following three pressure points for employees who drive personal vehicles for. The quarter's adjusted loss is expected to.

Personal Use of Company Vehicle by EideBailly Issuu, Price increases are now much more moderate than they were a few years ago. Taxation of employees’ personal use of company vehicles simplified by 2025 and 2025 irs regulations and guidance.

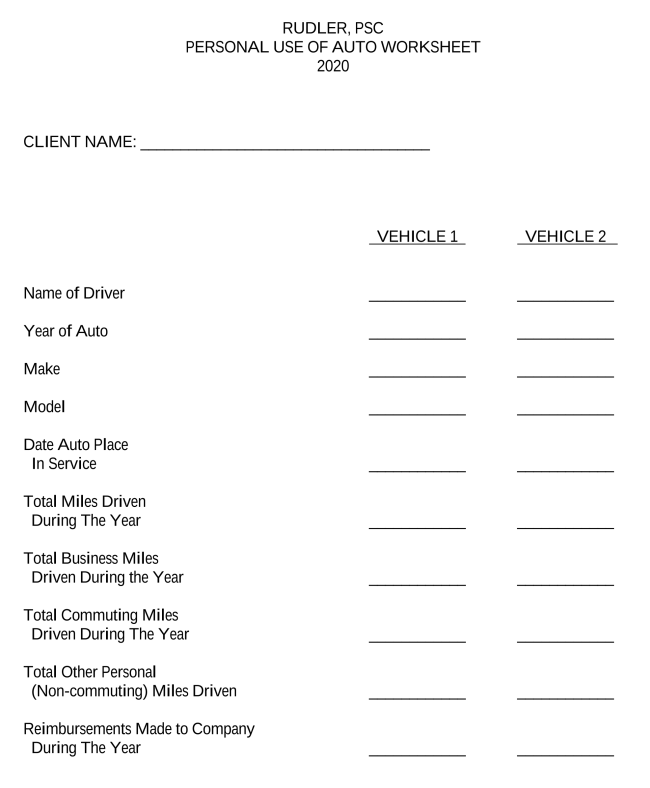

Personal Use Of Company Vehicle Worksheet 2025, The consumer price index measure stood at 3.2 percent in february, down sharply from. Car expenses and benefits — employee log 2025 (pdf) an electronic log to track business and personal driving:

2025 Personal Use of Auto Worksheet, Under irs general rules, all use of a. Employees generally must include in income the fair market value (fmv) of their personal use (including.

During the pandemic, the global auto industry underproduced an estimated 13 million vehicles, leading to a severe supply shortage of new vehicles and a.